sharynbidmead7

About sharynbidmead7

The Ins and Outs of $500 Personal Loans for Bad Credit

Navigating financial challenges can be daunting, especially in the case of securing a loan with dangerous credit. For a lot of people, a $500 personal loan can present much-wanted relief in times of monetary distress. This text will discover the character of personal loans, the implications of bad credit, and the options available for obtaining a $500 loan despite credit score challenges.

Understanding Personal Loans

A personal loan is an unsecured loan that can be used for various functions, equivalent to debt consolidation, medical bills, or unexpected emergencies. Unlike secured loans that require collateral, personal loans rely on the borrower’s creditworthiness and capacity to repay. The loan amount, curiosity rate, and repayment terms range based on the lender’s assessment of the borrower’s monetary state of affairs.

The Impression of Dangerous Credit score

Bad credit score is typically defined as a credit rating below 580 on the FICO scale. This could consequence from varied components, together with late payments, excessive credit score utilization, or defaults on loans. A poor credit rating can significantly have an effect on a person’s capability to secure financing, as lenders view unhealthy credit as an indication of increased threat. Consequently, those with dangerous credit score might face greater interest charges, stricter phrases, or outright denial when applying for loans.

The need for a $500 Personal Loan

In lots of circumstances, individuals with unhealthy credit may find themselves in urgent need of a small loan, resembling $500. This quantity can cover unexpected bills like car repairs, medical payments, or important household wants. While the amount could appear modest, it could make a major difference for somebody struggling financially. However, discovering a lender keen to supply a loan under these circumstances can be challenging.

Choices for Securing a $500 Personal Loan with Bad Credit score

- Credit score Unions: Credit unions are nonprofit organizations that usually offer extra favorable terms in comparison with traditional banks. They could have extra lenient lending standards and could possibly be prepared to increase a $500 personal loan to those with bad credit, especially if the borrower is a member of the credit union.

- Online Lenders: The rise of on-line lending platforms has remodeled the borrowing panorama. Many on-line lenders concentrate on offering loans to individuals with unhealthy credit. These platforms often use alternative knowledge to evaluate creditworthiness and may supply faster approval times than traditional lenders. Borrowers ought to rigorously analysis online lenders to ensure they’re reputable and clear about fees and phrases.

- Peer-to-Peer Lending: Peer-to-peer (P2P) lending platforms connect borrowers with individual buyers keen to fund their loans. These platforms could also be extra versatile with credit requirements, permitting individuals with dangerous credit to safe a $500 loan. Nonetheless, interest charges can fluctuate widely, so borrowers must be cautious and skim the high quality print.

- Payday Loans: While payday loans are an option for quick cash, they include vital risks. These quick-term loans sometimes have excessive-interest charges and fees, which might lead to a cycle of debt if not managed rigorously. Borrowers ought to consider this option solely as a final resort and ensure they have a plan for repayment.

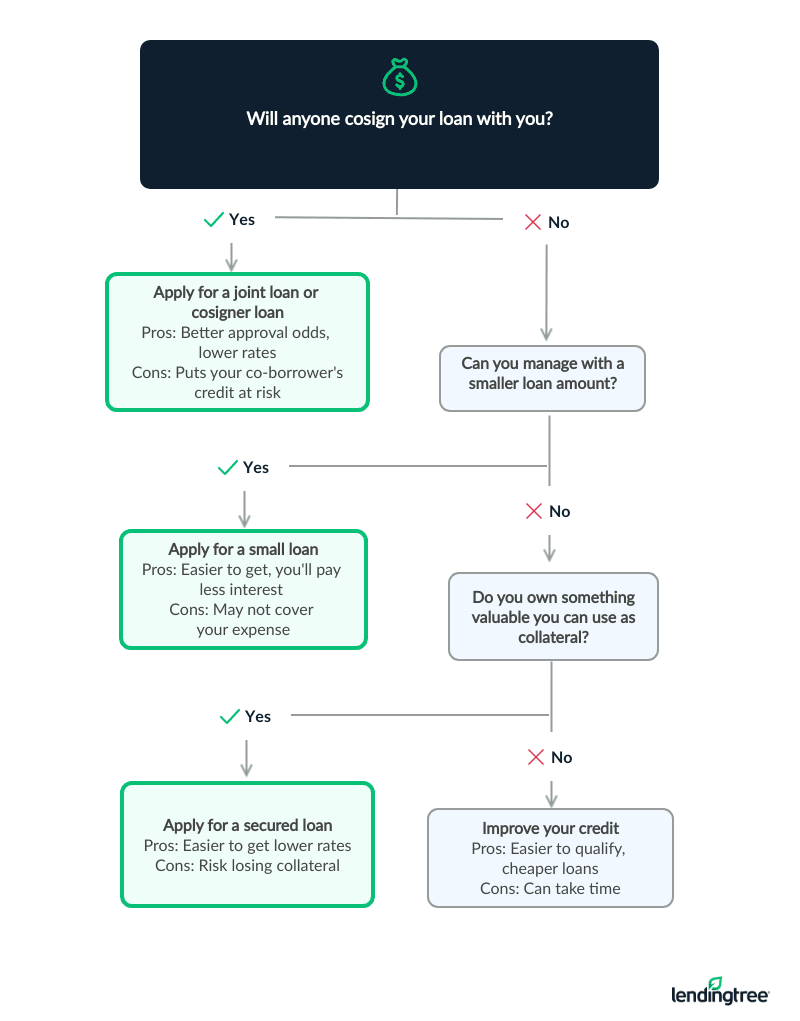

- Secured Loans: If a borrower has an asset, reminiscent of a car or savings account, they might consider a secured loan. By providing collateral, individuals with dangerous credit may entry better loan phrases and lower interest rates. Nevertheless, this option carries the danger of dropping the asset if the loan will not be repaid.

Making ready to use for a $500 Personal Loan

Before making use of for a personal loan, borrowers should take several steps to improve their possibilities of approval:

- Examine Credit score Experiences: Individuals ought to overview their credit reports for errors, as inaccuracies can negatively impact their credit score scores. If you have any issues pertaining to where by and how to use personalloans-badcredit.com, you can call us at our webpage. Correcting any errors can enhance the probabilities of securing a loan.

- Gather Documentation: Lenders sometimes require documentation to evaluate a borrower’s financial state of affairs. This will include proof of income, employment verification, and identification. Having these documents ready can streamline the applying course of.

- Consider a Co-Signer: If potential, people could seek a co-signer with good credit score to enhance their possibilities of approval. A co-signer agrees to take on the duty of the loan if the primary borrower defaults, which can present additional security for the lender.

- Explore Alternate options: Earlier than committing to a loan, borrowers ought to consider alternative choices, equivalent to negotiating payment plans with creditors, searching for help from nonprofit organizations, or exploring neighborhood resources.

The Significance of Accountable Borrowing

Whereas a $500 personal loan can provide immediate relief, borrowers must approach the method with caution. Excessive-curiosity charges and unfavorable phrases can lead to further monetary pressure if not managed properly. It’s essential for individuals to assess their capacity to repay the loan before borrowing. Creating a funds and understanding the overall value of the loan, including curiosity and fees, can assist borrowers make knowledgeable selections.

Conclusion

Securing a $500 personal loan with dangerous credit score could appear challenging, however numerous choices can be found for those in need. By understanding the implications of bad credit, exploring completely different lending avenues, and making ready adequately, individuals can discover the monetary assist they require. However, accountable borrowing is important to keep away from exacerbating monetary difficulties. In the end, the purpose ought to be to search out a solution that not solely meets quick wants but also contributes to lengthy-term monetary stability.

No listing found.